2024 Mn Income Tax Brackets. Deduct the amount of tax paid from the tax calculation to provide an example. Use our income tax calculator to find out what your take home pay will be in minnesota for the tax year.

The calculator is updated with the latest tax rates and brackets as per the 2024 tax year in minnesota. 12 announced the 2024 individual income tax brackets and standard deduction and dependent exemption.

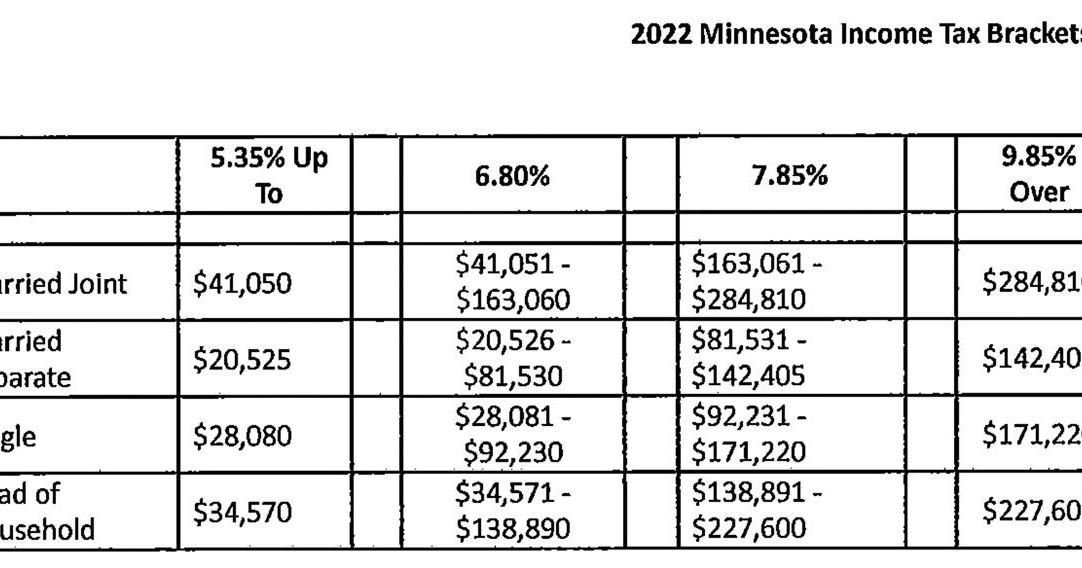

These Tables Outline Minnesota’s Tax Rates And Brackets For Tax Year 2024.

Minnesota residents state income tax tables for single filers in 2024 personal income tax rates and thresholds;

For Tax Year 2024, The State’s Individual.

Minnesota’s 2024 income tax ranges from 5.35% to 9.85%.

The Minnesota Department Of Revenue (Dor) Dec.

Images References :

Source: www.walkermn.com

Source: www.walkermn.com

Minnesota tax brackets, standard deduction and dependent, The minnesota department of revenue (dor) dec. This annual adjustment will prevent taxpayers from paying taxes at a higher rate solely because of inflationary changes in their income.

Source: kissiewzarah.pages.dev

Source: kissiewzarah.pages.dev

2024 Tax Brackets And Deductions kenna almeria, See current federal tax brackets and rates based on your income and filing status. Under the extended tax credits, any household with income above 200% of the federal poverty guidelines may potentially qualify for a tax credit, but there is an income amount.

Source: anettaqrosalyn.pages.dev

Source: anettaqrosalyn.pages.dev

Minimum To File Taxes 2024 Over 65 Clari Rhodia, These tables outline minnesota’s tax rates and brackets for tax year 2024. 12 announced the 2024 individual income tax brackets and standard deduction and dependent exemption.

Source: estatecpa.com

Source: estatecpa.com

Minnesotataxbracket » Estate CPA, The minnesota department of revenue announced the adjusted 2024 individual income tax brackets. See states with no income tax and compare income tax by state.

Source: www.americanexperiment.org

Source: www.americanexperiment.org

Minnesota ranks 8th nationally for its reliance on taxes, The minnesota standard deduction for the 2023 tax year (filed in 2024) is $13,825 for single filers. Under the extended tax credits, any household with income above 200% of the federal poverty guidelines may potentially qualify for a tax credit, but there is an income amount.

Source: liesaqrivkah.pages.dev

Source: liesaqrivkah.pages.dev

Tax Brackets 2024 Single Meggi Aveline, Tax rate taxable income threshold; 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Irs Single Elana Harmony, Enter your details to estimate your salary after tax. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Under the extended tax credits, any household with income above 200% of the federal poverty guidelines may potentially qualify for a tax credit, but there is an income amount. For married couples, the standard deduction is $27,650 total if filing jointly and $13,825 (each) if filing.

Source: rozelewjori.pages.dev

Source: rozelewjori.pages.dev

Tax Brackets 2024 Irs Table Ronni Tommie, 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). For tax year 2022, the state’s individual income tax.

Source: jerrilynwdaisie.pages.dev

Source: jerrilynwdaisie.pages.dev

2024 Tax Brackets Chart Vonni Johannah, A comprehensive suite of free income tax calculators for minnesota, each tailored to a specific tax year. Explore the latest 2024 state income tax rates and brackets.

12 Announced The 2024 Individual Income Tax Brackets And Standard Deduction And Dependent Exemption.

This page has the latest minnesota brackets and tax rates, plus a minnesota income tax calculator.

Deduct The Amount Of Tax Paid From The Tax Calculation To Provide An Example.

The minnesota standard deduction for the 2023 tax year (filed in 2024) is $13,825 for single filers.